News

Accounting Service

Here's Why Businesses Need Tax Compliance Services

Running a business in Hong Kong comes with many responsibilities. Staying compliant with tax rules is one of the most important things that a business does. Hong Kong has a simple tax system, but t...

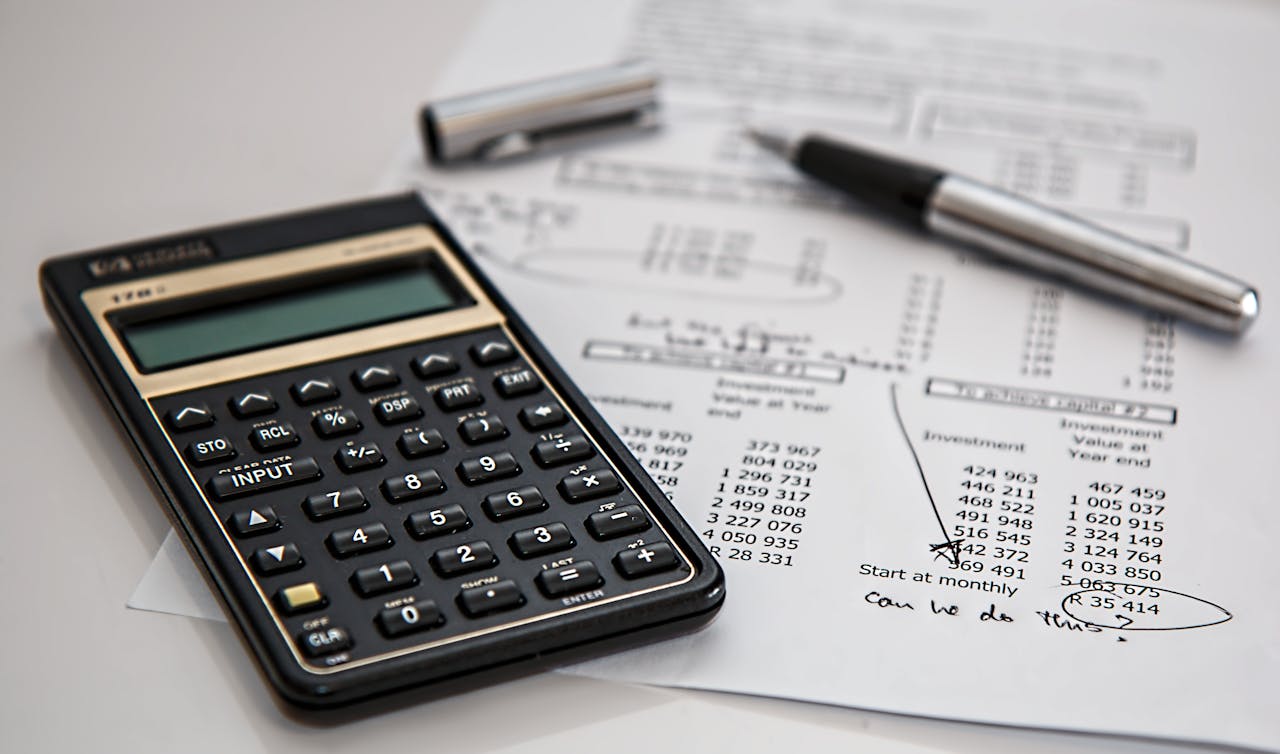

accountant for taxes

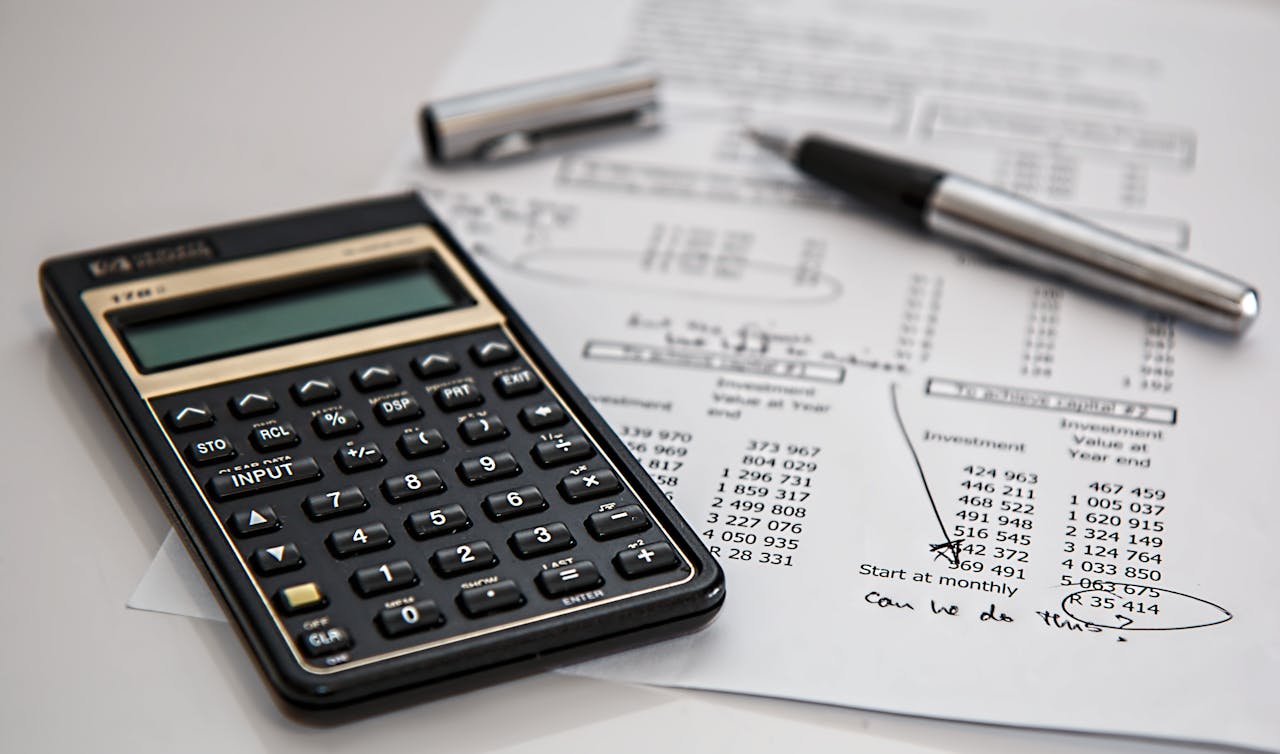

Streamline Your Finances with Our One-Stop Accounting & Bookkeeping Services

One way to succeed in this fast-paced business environment is maintaining accurate and up-to-date financial records. Professional accounting and bookkeeping services provide businesses with the exp...

Accounting Service

Do Small Businesses Need Auditing? Top Frequently Asked Questions Answered

When people hear the word audit, they often think of large corporations with complex finances. But the truth is, auditing is very important even for small businesses. Whether you are a startup or a...

Accounting Service

Pastel Payroll Online as The Leading Payroll Software for Your Business

Along with the development of technology in this digital era, new business owners want everything to be more practical and easier in managing office finances. One of the things that is a problem in...

Accounting Service

Introducing Pastel My Invoicing as Your Business Invoice Solution

Running a new business requires a lot of preparation, especially in the financial section. Every new business need accounting software to streamline and automate their financial process. There are ...

Accounting Service

Sage Online Accounting Software For Business

Today we are entering a fast-paced business landscape where business can be done online and offline, plus there are many things that must be tackled for small and medium-sized businesses. One of th...

accountant for taxes

Accounting and Taxation in Hong Kong: A Comprehensive Guide

Accounting and taxation in Hong Kong is governed by a territorial taxation system where only income generated in or derived from Hong Kong is subject to tax, and the guide covers various types of t...

accountant for taxes

逃稅大起底!香港稅局火眼金睛,你不可不知的生死存亡線!

香港,以其低稅率和簡化的稅務架構,成為了全球企業家、外國投資者以及高淨值人士的優選之地,有力推動了經濟的繁榮發展。然而,這份吸引力同時也伴隨著逃稅問題的挑戰。鑒於逃稅可能導致的法律後果極為嚴重,無論是個人還是企業,深入瞭解逃稅行為及其法律後果,以及如何遵守稅法,顯得尤為關鍵。

逃稅?NO WAY!這不是玩火,是玩命!

逃稅,本質上是故意逃避或減少應向稅務機關繳納的稅款,屬於非法行為。行為...

accountant for taxes

傳票來了,香港公司請注意:忽視=大錯特錯!

在商業運營中,香港公司收到法院傳票是一個不容忽視的問題,這不僅關乎公司的聲譽,還直接影響到公司及其負責人的法律責任。最近,一位客戶焦慮地向我們諮詢:“他的香港公司為什麼會收到法院的傳票呢?不理會可以嗎?”針對這一疑問,我們將詳細探討其背後的原因及忽視可能招致的後果。

為何會收到法院傳票?

香港公司收到法院傳票的原因多種多樣,但最為常見的兩大原因是未按期辦理年審以及未按期辦理稅務申報工作。...